Cintra IQ holds a number of standard payroll reports which can be used for checking payroll input. The standard reporting in reports such as Gross to Net will total gross pay as determined by Reporting Groups that are defined at setup.

TABLE OF CONTENTS

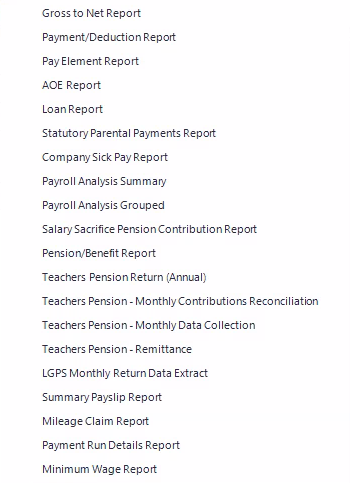

- Standard Payroll Reports

Standard Payroll Reports

All of the standard payroll reports can be found under Payroll > Payroll Tools > Payroll Reports. Generally, these reports require the following information:

- A payroll and payroll period

- People who should appear on the report (all, individual or multiple employees)

- A sort order (not all reports require a run order)

(click to expand)

Altered Pay Report

This report is a useful starting point. It shows the difference between pay in this period and last period.

You can give the report tolerances so that you are only reporting over/under certain limits and you can exclude starters and/or leavers. As default, "Payments" is selected but you can run the report in any of the groups.

Payroll Analysis Report

This report will show you a breakdown of all of the totals in the period and a breakdown of each payment. The gross pay analysis section of this report would help you when checking payroll period input.

Payment/Deduction Report

You may want to breakdown some of the adjustments further so use the Payment/Deduction Report to do this.

Select whether the report is for a payment or deduction then click Next.

Next, select the adjustment/s on which you want to report – or just click Select All to have a detailed analysis of every adjustment. If you are running this for audit purposes it would be sensible just to save the report in your internal periodic reports folder. The report will give you a sub-total of each adjustment which will match the totals of the Summary

Report.

Gross to Net Report

The columns in this standard report can be broken down as defined by reporting groups, e.g. if you would like to see basic salary as a separate column. For more information, see Gross Pay Reporting.

Pension/Benefit Reports

Pension/Benefit Reports can be detailed or shown in an All Pension Scheme Summary report or in an All Benefit Scheme Summary report. Again you can report for a specific period or year-to date.

Individual Scheme Report

You can see from the above that within a Scheme, if you want to show detail, you can choose to Run by Contribution Rate (particularly useful for LGPS reporting), Employment ID or Surname.

You can also just run the report by subtotals for either Contribution Rate or Scheme (only relevant if you are reporting over more than one scheme).

All Pension Schemes Summary

This report will show all of the totals by Pension Scheme and shows a headcount.

All Benefit Schemes Summary

This report will show all of the totals by Benefit Scheme and shows a headcount.

AOE Report

This report shows details of AOE deductions made in the period, to date amounts and any outstanding balances. You can select all, multiple or a single AOE payment heading by clicking in the relevant box.

When the report is shown on the screen Click the + sign next to each AOE type to see the employees who have that particular AOE deduction then click the + next to the Employee ID number to see details for that employee.

Loan Report

This report shows details of loan deductions made in the period, the principal amount of the loan, to date deductions and any outstanding balances. You can select all, multiple or a single loan deduction heading by clicking in the relevant box.

When the report is shown on the screen click on the + to see the detail.

Summary Payslip Report

This report is useful for checking payslips as it shows several payslips on one page rather than having one payslip per page (if you printed the payslips from the Payslip Print option).

Duplicate Bank Details Report

This report will show employees who have duplicate bank details. You can run this report for

an individual payroll or for multiple payrolls.

Bank Details Exceptions Report

You would expect this report to be blank.

Duplicate Name Report

If there are employees with the same name check the Employment ID number and / or NI

number is different for each person.

Payroll Audit Report

Double click on the yellow tabs for each individual to see more detail.

Correction Report

Select either Summary or Detail then click Select next to each type of correction you wish to

view.

See also: Reporting groups.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article