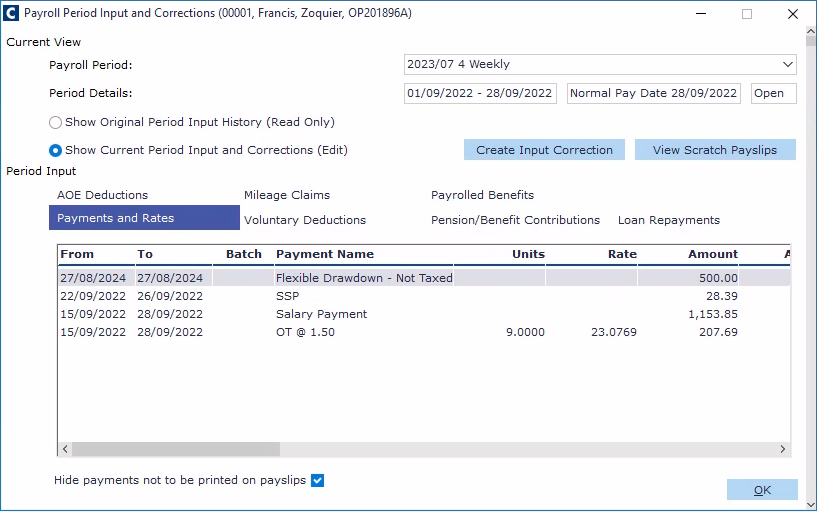

All the information relating to an employee's pay, deductions, benefits etc, can be viewed in the Payroll Period Input form held against their employee record. The articles below explain each of the tabs found in the form.

To access Payroll Period Input form for an employee:

- In the folder section to the left, select Employee Records.

- In the central navigator section, select an employee.

- In the Forms section to the right, click Payroll Period Input.

(click to expand)

| Task | Link |

|---|---|

| Inputting payments and rates | |

| Apply voluntary deductions | How do I set up/apply voluntary deductions against an employee? |

| Add pension & benefit contributions | How do I enter pension/benefit contribution data for the current period? |

| Enter mileage claims | How do I enter mileage claims for employees? |

| AOE deductions | You can only edit existing deductions, you cannot create new ones. How do I enter/change AOE deductions and protected earnings? |

| Voluntary deductions | How do I set up/apply voluntary deductions against an employee? |

| Add any corrections | How do I create corrections? |

| Add other payrolled benefits | To add other benefits, you must first this up under Expenses & Benefits. See How do I set up other payrolled benefit addition headings? |

| View a scratch payslip | How do I use a scratch payslip? |

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article