Accessing a payslip

- Within the Folders section on the left, select Employment Records.

- In the Navigator in the centre, select an employee record.

- In the list of Forms on the right, select Payslip. The employee's payslip summary appears.

- Selecting a different employee from the Navigator will automatically display the selected employee's payslip.

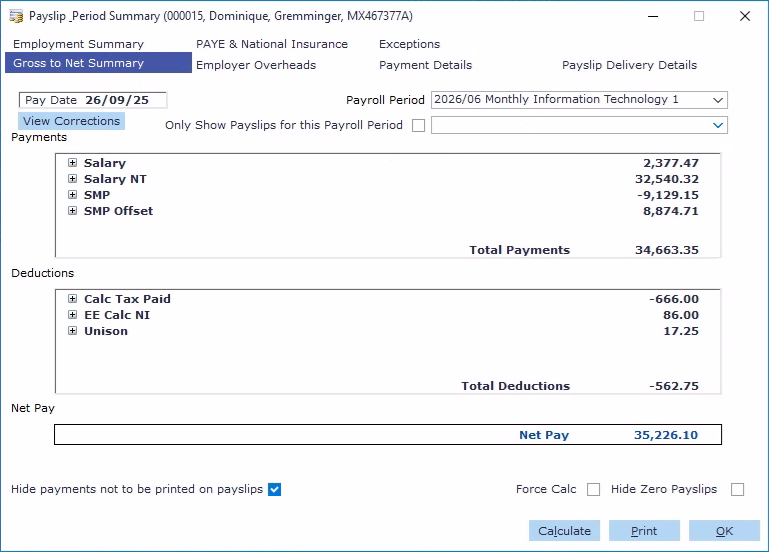

(click to expand the Payslip Summary screen)

Calculating / Force calculating the payslip

You can also (re)calculate the employee's pay from this screen. For more information on calculating payroll, see How do I perform a payroll calculation?

Payslip & Period Summary window tabs

| Tab | Description |

|---|---|

Gross to Net Summary tab | Within the Gross to Net tab, you can select the Payroll Period you want to view by using the Payroll Period drop down selection. You can view all payment details of all deductions made on net pay. You can view the Payment or Deduction calculations in greater detail in the Gross to Net Summary tab by double-clicking in either pane, or clicking the + beside a payment or deduction. |

Employment Summary tab | Within the Employment Summary tab, you can view the employee's administrative details such as Employee number, Status etc for the selected Payroll Period. |

Employer Overheads tab | Within the Employer Overheads tab, you can view the Employer's contributions and overhead costs for the selected Payroll Period. This includes the employees' national insurance and any employee's pension contributions. |

PAYE & National Insurance tab

| Within the PAYE & National Insurance tab, you can view the PAYE Tax information and National Insurance earnings and contributions for the selected period. |

Payment Details tab

| Within the Payments Details tab, you can view the BACS Payments and any other payment details of the employee's Net Pay for the selected period.

|

Statutory Benefits tab

| Within the Statutory Benefits tab, you can view the details of any SAP, SMP, SPP, SBP, SHPP, and/or SSP payments made to the employee. |

Exceptions tab

| Within the Exceptions tab, you can view any exceptions that occurred when the payroll was calculated for the selected period. |

Payslip Delivery Details tab

| Within the Payslip Delivery Details tab, you can view the employee's current address, pay point details and where the payslip is to be delivered for the selected period. |

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article