What is a mileage scheme?

When employees use their personal cars for work-related travel, excluding commuting to and from their regular workplace, they can log the miles travelled and be reimbursed based on a predetermined rate. This rate often takes into consideration factors such as fuel costs, wear and tear on the vehicle, insurance, and other expenses related to the use of the car.

| Name | Description |

|---|---|

| Annual Allowance | Annual Allowance is an annual amount paid to an employee for using their own vehicle for business miles. |

| Mileage Payments | Mileage Payments are set amounts paid for each business mile an employee does in their own vehicle. |

| Passenger Payments | Passenger Payments are set amounts paid for each passenger for each business mile an employee does with a passenger in their own vehicle i.e. if an employee has two passengers and does 60 miles, a payment would be made for 120 units and the appropriate passenger rate. |

How do I create a mileage scheme?

- Go to: Expenses & Benefits> Expenses Setup > Mileage Rates & Schemes. The Mileage Rates/Scheme definition window appears.

- Click New.

- Enter a Code & Description for the mileage rate/scheme.

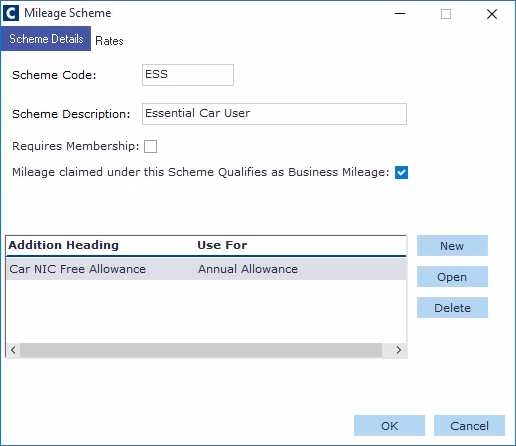

- Click Next. The Mileage Scheme window appears.

(click to expand)

- Requires Membership: If you require users to be added to this scheme before you can add a mileage claim for them, check this box.

- Mileage claimed under this Scheme Qualifies as Business Mileage: Any vehicle mileage recorded for non-business use does not qualify for any tax or NI relief. Therefore, if vehicles are used for both business and non-business purchases, you should create separate schemes to ensure that NI and tax is calculated correctly.

- Click the New button to create new addition headings for Annual Allowance, Mileage Payments, Passenger Payments or to use existing addition headings. The New Payment Heading form appears.

- From Mapping Use, select the heading you wish to map i.e. Annual Allowance.

- If you already have an addition heading created, select the Use existing addition heading option.

- Select the heading from the drop down.

- If you want to create a new addition heading, click the Create New Addition Heading option, enter the name of the addition heading in the field and then select the Reporting Group.

- Click the OK button. The Payment heading appears in the Scheme Details tab.

- Click the Rates tab.

- Enter the Annual Allowance, Mileage Payments, and/or Passenger Payment rates. You are now ready add employees to the scheme if they need to receive a regular allowance.

- Repeat the above steps if you wish to create addition headings for Mileage Payments and Passenger Payments.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article