What is small employer's relief?

Small Employer's Relief is a provision in the UK's National Insurance system designed to assist small employers in managing the financial burden of statutory payments, such as Statutory Maternity Pay (SMP), Statutory Paternity Pay (SPP), Statutory Adoption Pay (SAP), and Statutory Shared Parental Pay (ShPP).

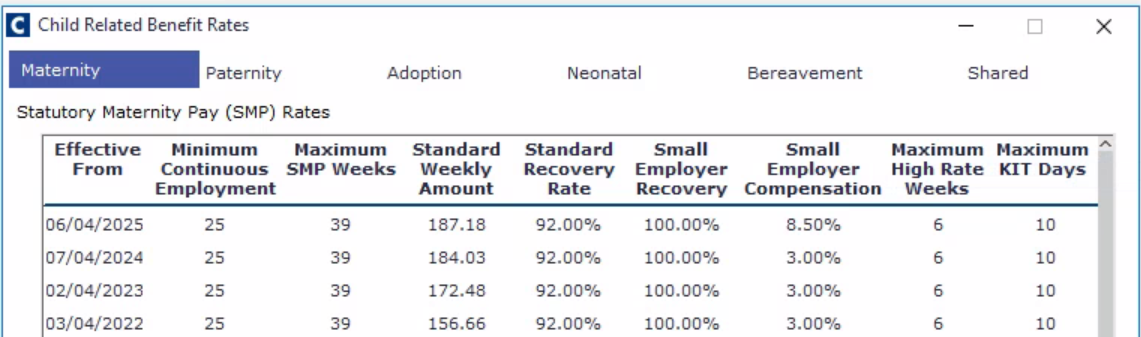

All employers can claim back 92% of any statutory payments made to employees. As of April 2025, small employers can claim 100% + a further 8.5% of all statutory payments through the scheme, which is designed for small businesses that face higher costs in providing statutory payments due to their smaller size.

Note: For a business to qualify for the scheme, they must have made less than £45,000 in NI contributions in the previous tax year. For more information, see financial help with statutory pay: What you can reclaim - GOV.UK

How do I create a small employer relief scheme?

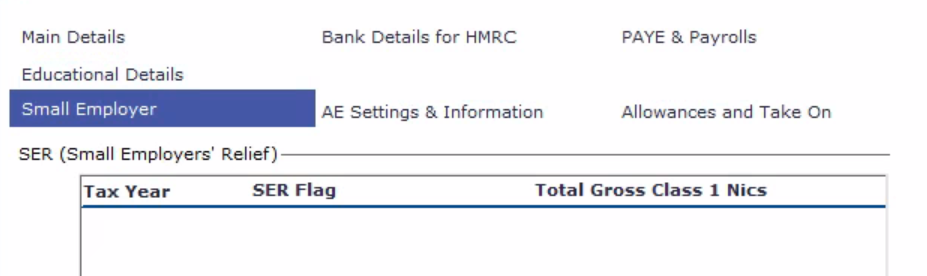

If you are entitled to Small Employer’s Relief (SER), this is set-up in the Employer Setup within Cintra iQ. You can nominate the company as Small for the relevant tax year and record the Gross NIC Contributions for the previous year as a memo:

- Go to: Payroll > Payroll Setup > Employer Setup. The Employers Definition window.

- Open the desired Employer definition. The employer window appears.

- Navigate to the Small Employer tab.

- Right-click: New in the SER (Small Employers' Relief) pane. The New PAYE Scheme form appears.

- Select the Employer Is Small (Qualifies for Small Employer Relief) option.

- Select the relevant tax year from the For Tax Year drop-down list.

- Enter the value for the Gross NIC Contributions For Previous Year (Memo).

- Click the OK button.

Setting up schemes later in the tax year

Ideally, the Small Employer Relief scheme should be set up at the start of the tax year. However, if you set it up later in the year, then Cintra iQ will NOT automatically adjust amounts from previous submissions. To counteract this, you should generate a correction for the employees for whom you can reclaim their statutory pay. This will cause the adjustment to be applied with the small employer's relief rate (108.5%) rather than the standard percentage rate.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article