You can calculate an hourly rate or daily rate at which to assign to holiday pay. This rate is based on the average rate of pay accumulated over several historical periods.

TABLE OF CONTENTS

- How does iQ calculate average rate of pay?

- Before you calculate Holiday Pay

- To configure Average Holiday Pay Rate Settings

- Average Holiday Pay Fields Information

How does iQ calculate average rate of pay?

- The number of historical weeks required: The default and recommended minimum is 52 weeks, but you can change this.

- If the employee has not been employed for the full number of weeks, iQ uses the number of existing pay periods available.

- The option to calculate over payroll periods instead of weeks is less accurate and can no longer be chosen. XX

- Relevant pay for each period: For more information, see How Do I Determine Relevant Pay?

- Contractual hours/days per period: For more information, see How Do I Set Contractual Hours/Days?

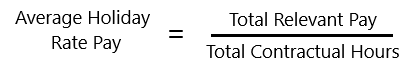

To calculate the holiday rate, iQ divides the total relevant pay by the total contractual hours across the selected periods.

Note: Only closed payroll periods are included in the average holiday rate calculation

Before you calculate Holiday Pay

Make sure to define:

- How many historical weeks to include.

- Whether specific weeks should be excluded when pay falls below a certain level.

- How many weeks to include in the extended history if any weeks are excluded.

To configure Average Holiday Pay Rate Settings

- In Cintra iQ, go to Payroll> Payroll Setup> Employer Setup.

- Within the Employers Definitions screen, double-click an employer.

- Click the PAYE & Payrolls tab.

- In the Payrolls associated with the selected PAYE Scheme section, double-click a payroll.

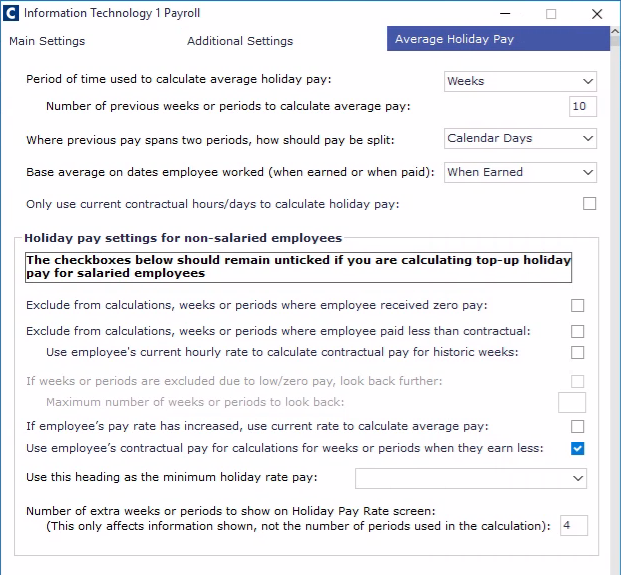

- Click the Average Holiday Pay tab.

- Navigate to the Holiday Pay Rate Calculation Settings section.

- You can now make changes to the holiday pay settings. See the tables below for more information.

- Click OK to save any changes.

You are now ready to set up Addition Headings.

(click to expand Average Holiday Pay screen)

Average Holiday Pay Fields Information

SETTINGS FOR ALL EMPLOYEES

| Field | Description |

|---|---|

| Period of time used to calculate average holiday pay (weeks): | Only "Weeks" can be used when setting up this screen for the first time. Previously, customers could select between months (periods) or weeks when calculating holiday pay. However, the ability to select months has been withdrawn as this is a less accurate way to calculate holiday pay. |

| Number of previous weeks or periods to calculate holiday pay: |

|

| Where previous pay spans two periods, how should pay be split: | When a previous payroll period's pay spans more than a single week, you must decide whether the pay is split according to:

|

| Base average on dates employee worked (when earned or when paid): | Choose whether to base holiday pay on:

|

| Only use current contractual hours/days to calculate holiday pay: | If selected, only the employee’s current contracted hours/days will be used. Historical changes in contracted day/hours will be ignored. |

SETTINGS FOR NON-SALARIED EMPLOYEES

| Field | Description |

|---|---|

| Exclude from calculations, weeks or periods where employee received zero pay: | If selected, Cintra iQ:

|

| Exclude from calculations, weeks or periods where employee paid less than contractual: | If selected, Cintra iQ:

|

| Use employee's current hourly rate to calculate contractual pay for historic weeks: |

|

| If weeks or periods are excluded due to zero/low pay, look back further: |

|

| Maximum number of weeks or periods to look back: | Specifies how many additional weeks or periods Cintra iQ should look back to find valid pay data when exclusions are applied. The standard is 104 weeks. |

| If employee's pay rate has increased, use current rate to calculate average pay: | If selected, this will recalculate historical pay using the employee’s current rate if their hourly or daily rate has increased during the calculation period. |

| Use employee's contractual pay for calculations for weeks or periods where they earn less: | If selected, this ensures that any week where actual pay is below contractual pay is still valued at the contractual rate for holiday pay calculations. |

| Use this heading as the minimum holiday rate pay: |

|

| Number of extra weeks or periods to show on Holiday Pay Rate screen: |

|

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article