Within Cintra iQ, you can create all different pension scheme types to enable the correct deductions from both employee and employer contributions. These schemes are linked to payees for payment and provision of output files.

They are also linked as appropriate to the pension auto-enrolment functionality so that this process can be managed efficiently.

If you operate Fixed Amount or Percentage Contributions for regular pension schemes, you need to ensure that the Employee Contribution Rates are created within Cintra iQ. For more information, see How do I set up new pension schemes?

TABLE OF CONTENTS

reate a new / edit an existing scheme

- Go to Cintra iQ: Payroll> Payroll Setup> Benefit Schemes> Pensions/Other Benefits.

- Either open an existing scheme or create a New one (you will need to assign it a Name and Scheme type).

- Within the Scheme Details tab of the Pension Scheme, enter information about the scheme and its provider.

Setting contributions

- Within the Scheme Parts section of the Contributions tab, right-click and click New.

- In the New Contribution form, enter its name and the following information:

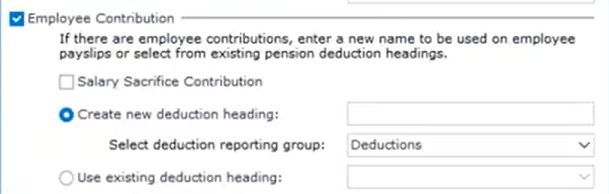

Employee contribution

- Check the box if this contribution is to be a Salary Sacrifice Contribution.

- Either create a new Deduction Heading or select an existing one.

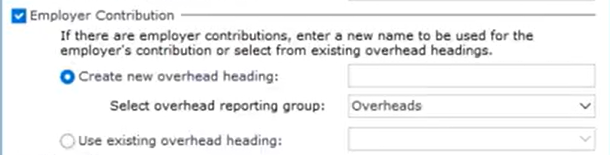

Employer contribution

- Create a new Overhead heading (max 12 characters) or select an existing one.

- You can select which Overheadreporting group you wish these to appear under in the Gross to Net report.

- Where possible, use a new heading as it makes reporting easier!

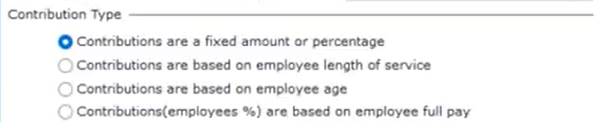

Contribution type

With Contributions are a fixed amount or percentage selected, click Next.

Main Contribution Attributes

- If the contribution is an additional voluntary contribution, check the box and select a type.

- Select any auto-enrolment and further settings. See How do I define pension scheme parts as supporting auto enrolment?

Setting employee rates

- Click the Employee Contribution Rates tab.

- Right-click and select New.

- Select the effective from/to dates.

- Select whether contributions are percentage based or set amounts, then enter the % amount or set contribution(s).

Setting employer rates

- Click the Employer Contribution Rates tab.

- Right-click and select New.

- Select the effective from/to dates.

- Select whether contributions are percentage based or set amounts, then enter the % amount or set contribution(s).

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article