TABLE OF CONTENTS

Performing the calculation

For an entire payroll

- In Cintra iQ, go to Payroll Tools > Payroll Calculation.

- Select the Payroll option, then choose which payroll you wish to calculate.

- A list of pending changes and the associated employee will be displayed. Double-click any change to view more information.

- Click Calculate.

- This may take a few minutes, depending on the size of the payroll.

- If any exceptions occur, you can view/print the report. You can also view any payroll exception report at any point.

- The list of pending changes will then be cleared.

For an individual employee

- In Cintra iQ, go to Payroll Tools > Payroll Calculation.

- Select the Payroll option, then select Individual.

- Either select an individual from the drop-down list, or select an employment record in the Navigator area.

- A list of pending changes for that employee will be displayed. Double-click any change to view more information.

- The list of pending changes will then be cleared.

You can also perform the calculation (including forcing the calculation) from an employee's payslip. See

Force / recalculating a payroll

When you calculate the payroll (either for an individual or an entire payroll), there is an option to force calculate the payroll.

Force calculation ensures that ALL changes - not just those listed in the Pending changes section - will be used in the calculation. Selecting Force Calc ensures these updates are recalculated from scratch, but can mean validation issues are ignored.

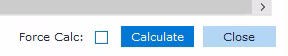

To perform a force calculation, follow the steps below for either a payroll or employee, tick the Force Calc option, then click Calculate.

If you recalculate the payroll which has an unauthorised payment run, the following message will appear:

For more information, see How do I create/re-run payment runs?

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article